Recently, cyclical stocks represented by coal and non-ferrous have suddenly seen a strong rebound. Is this rally sustainable? What is their investment logic? I remember at the beginning of the month, we pointed out to you from the perspective of the Kitchin cycle, the investment opportunities of non-ferrous stocks, has risen from more than 4 yuan to 7.5 yuan, so that has been investing in pharmaceutical stocks investment based on the depressed trainees, received some relief.

The investment logic of Luoyang Molybdenum is because he acquired a cobalt mine ranked second in the world: in June 2017, the company's non-public offering of A shares was approved by the China Securities Regulatory Commission for approval, and after adjustments, the company intends to issue no more than 5.769 billion shares at no less than 3.12 yuan/share in a non-public offering for a total proceeds of no more than 18 billion yuan to acquire the copper and cobalt asset acquisition project of the Democratic Republic of the Congo (DRC) (8.5 billion yuan). The subject of the DRC copper and cobalt asset acquisition project is the equity interest of FMDRC100% under FCX, which indirectly holds the equity interest of TFM56% located in the DRC, and the Tenke Fungurume mining area owned by TFM is one of the copper and cobalt mines with the largest reserves and the highest grade in the world. The above acquisitions are not contingent on the successful implementation of the private share issuance, and if the private share issuance is not successfully implemented, the Company will still use its own funds to pay the transaction consideration for the asset acquisition project.

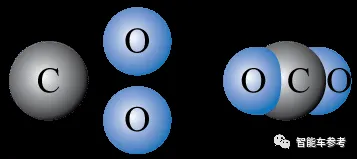

Cobalt is mainly used inTernary lithium battery The cathode material of the lithium battery can significantly improve the energy intensity of the lithium battery. Maybe the average investor thinks that a small anode material, and the so-called ternary material (lithium nickel cobalt manganate Li(NiCoMn)O2), which is a compound of three substances, nickel lithium manganese, can be more lucrative than the production of lithium batteries Tianqi lithium industry?

It depends on the proportion of cobalt cost in the price of lithium battery and China's cobalt resource reserves and consumption. China's proven reserves of cobalt is about 80,000 tons, accounting for 1.8% of the world's proven reserves, and the distribution of mines is extremely scattered. China consumes more than 30% of the world's cobalt. The world's largest cobalt reserves is the Luoyang Molybdenum acquisition of the Democratic Republic of the Congo, accounting for the world's reserves of 48%, the annual production of cobalt metal in the Democratic Republic of the Congo is 60,000 tons, accounting for the global cobalt production of 60% or so, close to China's total reserves.

How much does ternary material account for the cost of lithium battery? According to estimates, 1 ton of lithium cobaltate, lithium content is only 0.07 tons, but the cobalt content to reach 0.61 tons, more than 8 times the lithium. However, the content of cobalt in the earth's crust is only one-sixth of lithium, and the annual cobalt mining is only half of the lithium mine. 43kWh of electric capacity, priced at 230,000 yuan, can be taken to 40kWh capacity of electric vehicles priced at 200,000 yuan, with reference to 30kWh of new energy vehicles consume cobalt 7.54kg, 40kWh of the car cobalt demand can reach 10.05kg per vehicle. current new energy vehicle industry The current gross profit margin of new energy automobile industry is about 25%, and the cost can be estimated to be about 150,000 RMB. The current battery cost is about 1400 yuan/kWh, totaling 56,000 yuan, accounting for 37% of the whole cost, and other costs are 94,000 yuan. This year, at the end of March, cobalt tetraoxide 390,000 yuan per ton, 4.35V lithium cobaltate price of 415,000 yuan per ton; ternary materials (523) price of 19.5 million yuan per ton. You can roughly estimate the proportion of the cost of cobalt in lithium batteries.

[___Zhongshun Xinneng Human Resources Department July 24, 2017 Responsibility: Xiaogeng]