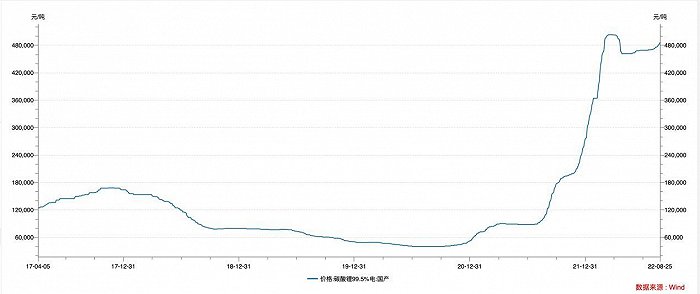

Recently, the price of battery-grade lithium carbonate has risen sharply, triggering market concerns.

How to deal with rising lithium prices? Government departments and relevant associations are urging enterprises to strengthen self-discipline, promote the cooperation of upstream and downstream enterprises, a number of arrows for the lithium price "cooling".

China Nonferrous Metals Industry Association vice president Jia Mingxing said that at this stage, the price of lithium carbonate has risen very much, and although there has been a slight retracement recently, the price of battery-grade lithium carbonate on the market is still maintained at 420,000 yuan/tonne or more. Lithium prices, represented by lithium carbonate, from the supply side, has greatly stimulated the investment and expansion of the lithium project in question, the capital expenditure of enterprises has increased, and the enthusiasm for recycling lithium has also improved. But from the entire industrial chain, the continued rise in raw material prices increased the manufacturing costs of lithium battery materials, lithium power batteries, lithium new energy vehicles and other midstream and downstream industries, coupled with the price of the market transmission mechanism is not sufficient, will inevitably affect the entire lithium industry chain within the supply chain of the smooth flow of the cycle.

Lithium prices rose mainly due to the new energy vehicles on the lithium demand has increased significantly. New energy vehicles in the consumption of lithium in a larger share of power batteries, whether it is now lithium-ion batteries, the next generation of lithium solid-state batteries, or lithium-air batteries in the future, the core of which is "lithium". Since last year, the global demand for new energy vehicles to achieve ultra-high-speed growth, lithium battery production capacity and production of anode materials, electrolyte and other key materials production capacity of rapid expansion, resulting in an increase in demand for lithium carbonate and other lithium salts, thus promoting the price of lithium soared.

From the market supply side, China's lithium ore about 60% originated from imports, due to the supply channel is not smooth, certain countries on the lithium mining has introduced some policies, such as Australia's Piabara lithium mine part of the lithium concentrate in the spot market auctions, the transaction price is significantly higher, resulting in a strong expectation of the forward lithium price rise. Coupled with the epidemic led to the restart of Australia's lithium concentrate capacity to varying degrees of delay, and logistics obstruction affecting shipment, lifting the price of lithium.

Xu Aidong, chief expert and chief engineer of Beijing Antaike Information Co., Ltd, believes that the fundamental reason for high lithium prices is the mismatch between supply and demand, and the direct factor of this round of lithium price increase is the demand side pull, and the supply growth rate is far from catching up with the growth rate of downstream consumption.In 2021, China's new energy automobile sales growth of 1,60%, and the growth rate of the power battery production and installed capacity are 1,63% and 143%, the production growth rate of the four major anode materials in China is 97%, but the increase in the supply of lithium salt in China is only about 60%, which stimulates the price of lithium to soar.

How to deal with rising lithium prices?Xu Aidong said that government departments and relevant associations are urging enterprises to strengthen self-discipline, promote cooperation between upstream and downstream enterprises, a number of arrows for the lithium price "cooling".

In March 2022, the National Development and Reform Commission (NDRC) convened a forum for upstream and downstream enterprises in the lithium industry to exchange views on the price formation mechanism, bottlenecks in production and supply, and policy measures to maintain supply and stabilize prices, which has inhibited the expectation of an overly rapid rise in the price of lithium.

CICC research department electric new public environmental protection industry chief analyst Zeng Tao suggested that, on the one hand, in order to hedge the pressure of rising lithium prices, many lithium battery companies, car companies have begun to layout the lithium resources link, in addition to the direct layout of the upstream ore, salt lake, etc., lithium battery recycling is becoming an important supplement to lithium resources. On the other hand, from the perspective of technological innovation, the research and development of new electrochemical energy storage devices that do not rely on lithium, such as sodium-ion batteries, is also an important path to alleviate the tight supply of lithium resources. As the industry chain of lithium resources development efforts continue to increase, the development speed continues to improve, superimposed on the industrialization of new technology breakthroughs, lithium resources in the medium term supply tension is expected to be reversed, the price is expected to fall.

Jia Mingxing said that the Nonferrous Association and the lithium industry branch is studying the relevant work, hoping to establish as soon as possible to ensure that the lithium price stable mechanism. In terms of supply and demand, the relevant enterprises should increase the lithium mining resources on the scientific and technological innovation investment, so that the supply is more abundant, so that lithium carbonate battery price adjustment can return to the industry itself.

Jia star said, supply side, the current lithium price has exceeded the industry cost 10 times more, which will certainly stimulate a large number of lithium resources development and expansion. Although the new capacity to reach production takes a long time, but in the existing capacity conditions as far as possible to expand production has more space.

"Now that the price of lithium is so high, all lithium industry enterprises want to go full throttle and increase production." Xu Aidong believes that for the lithium industry enterprises, we should increase investment in research and development, and adopt more advanced technology to improve production efficiency. For example, the salt lake development enterprises to increase the proportion of lithium extraction from raw brine, breaking through the limitations of potassium and magnesium production. Mica development enterprises to increase the utilization of tailings resources to ensure the healthy and sustainable development of the industrial chain.

Xu Aidong at the same time called for enterprises in the actual operation of some of their own difficult to solve the problem, I hope that the relevant departments to speed up the issuance of domestic mining licenses, environmental assessment and energy assessment of the progress of the integration of domestic and foreign development of the two kinds of resources, with conditions to liberalize the production of nickel cobalt and lithium through the waste of lithium-ion batteries primary raw material imports, multi-channel to alleviate the pressure on the supply of lithium prices, "cool down! ".

(Source: China Chemical and Physical Power Industry Association)

[Zhongshun Xinneng Marketing Department September 6, 2022 Responsibility: Xiao Zheng]

Reprinted for the purpose of transmitting more information, and does not mean that we agree with its views and is responsible for its authenticity.